Definition: Cash Budget is a precise statement depicting anticipated projections about the cash receipts and payments for a specific time period. It is a type of functional budget that is useful for cash management in the organization.

A cash budget is essential for companies and is referred to as the “Nervous System of Budgetary Control“. Also, it is alternatively known as Cash Flow Plans.

It basically operates upon two components, i.e. Cash Receipts and Payments. These components are ascertained by analyzing cash movement inside and outside the business.

It is conducted for a limited period known as Planning Horizon. It assists in planning short-term investments and making necessary arrangements in case of Deficit.

By preparing cash budgets, organizations can reduce Cash Shortages and lower Ideal Cash Levels. Also, it helps in avoiding severe uncertain consequences in the absence of financial planning.

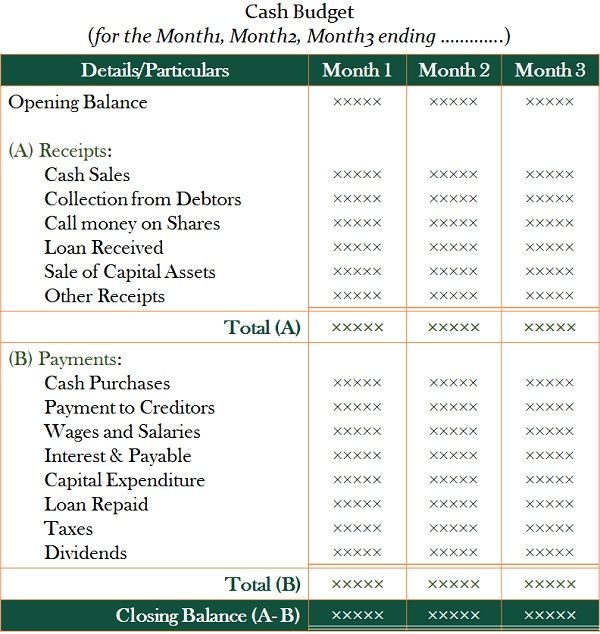

The format or we can say the formula for preparing a Cash Budget is as follows:

Besides Sales Budget, the cash budgets are also of greatest concern. The following points depict its importance, which are also the goals of preparing a Cash Budget:

The budgeting period for a cash budget varies depending upon:

Based on these, we can classify cash budget under three major categories:

The financial managers make use of the following methods for the preparation of cash budgets:

It is the most simplified method and is similar to Receipt and Payment Account. But, this statement contains forecasted receipts and payments for the budget period.

Under this method, we need to calculate the Closing Balance. For this, we add receipts and deduct payments in cash from the opening balance.

However, this method is suitable when preparing budgets for the Annual Profit Plan. It is generally prepared for the budgeting for a short duration of time.

Note: The statement excludes adjustments, whereas time lag must be carefully included.

Format

The format is the same as the one given above under the head Cash Budget Format.

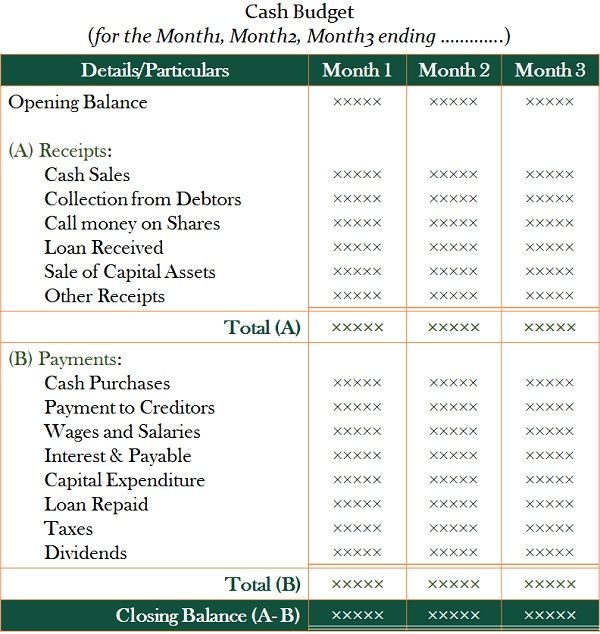

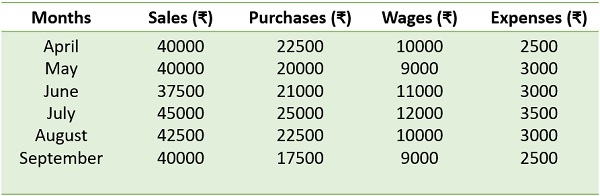

Create a Cash Budget for Instant & Co. using details below for the month of July, August and September 2009.

Solution:

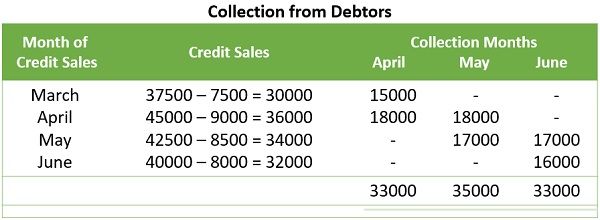

Working Notes:

July = 15th of June + 15th of July = 5500 + 6000 = 11500

Aug = 15th of July + 15th of Aug = 6000 + 5000 = 11000

Sept = 15th of Aug + 15th of Sept = 5000 + 4500 = 9500

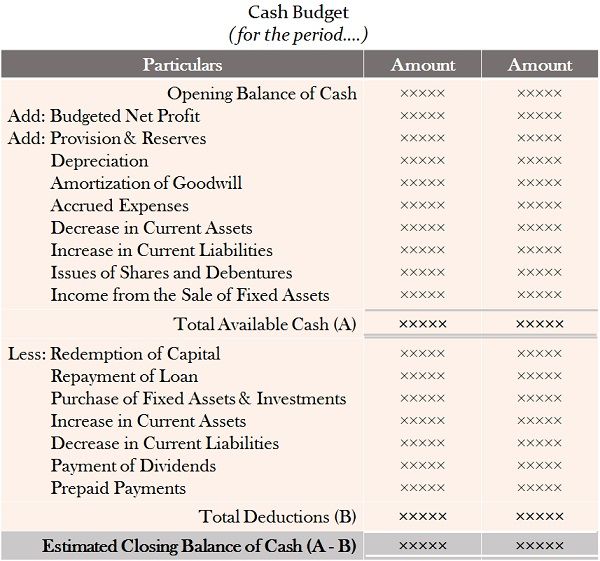

A variety knows it by names like – Cash Flow Method & Profit Cash Forecast Method. This method is very much like Cash Flow Statements but mainly focuses on forecasted data.

The managers prepare the Cash Budget using the following items:

Here, the cash budgeting begins by adding the Budgeted Net Profit to the Opening Cash Balance. After that, we make the following adjustments to the balance obtained:

After the above adjustments, we will get the closing balance of cash, i.e. expected cash, by the end of the budget period.

Format

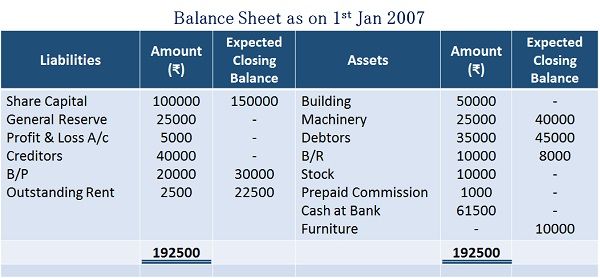

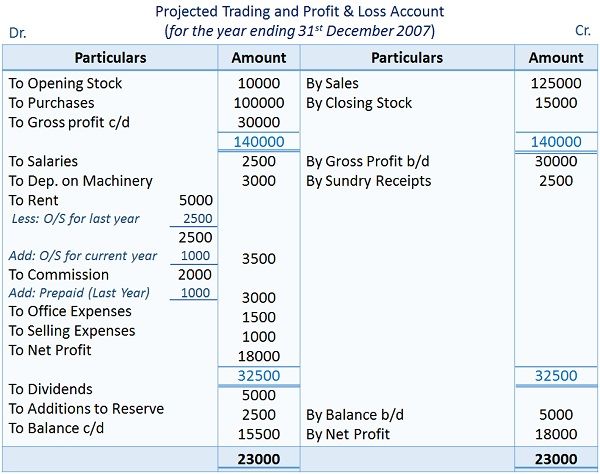

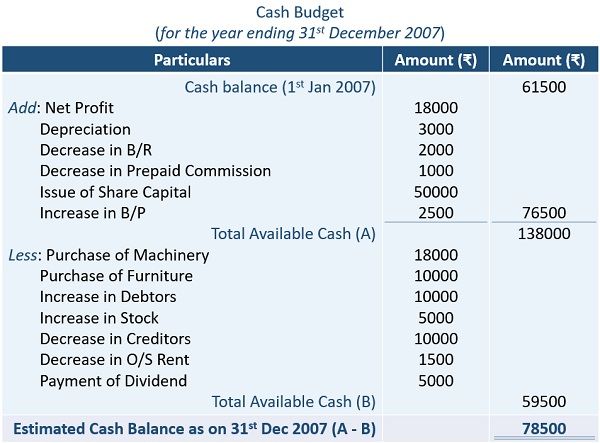

By using the data in the Balance sheet and Projected Profit & Loss A/c, prepare Cash Budget for December 31 2007.

Projected Trading and Profit & Loss Account

Solution:

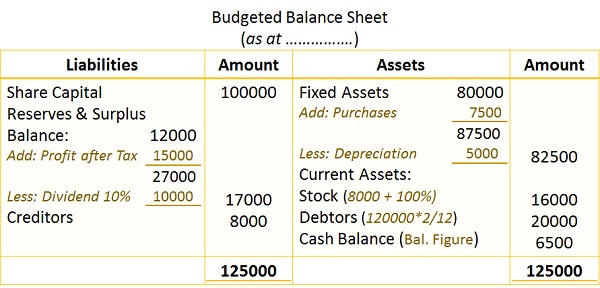

By this method, we can estimate the cash position at a particular time. For this purpose, we prepare a Budgeted Balance Sheet at the end of the budget period.

The asset side of the balance sheet depicts estimates about all Assets. On the other hand, the liability side shows projections about all Liabilities. And the product of the variance between the asset and liability side will be Cash Balance or Bank Overdraft.

Note: Initially, we exclude Cash, Bank and Bank Overdraft balances from the asset side.

The format of the Budgeted Balance Sheet is similar to the conventional Balance Sheet.

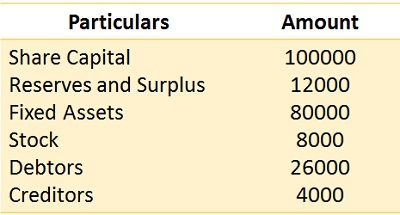

Based on the following information, prepare a Budgeted Balance Sheet to ascertain Cash Position.

Solution:

It is one of the frequently asked questions about Cash Budget.

There are certain generalized steps that one can follow during cash budget preparation. These steps are discussed hereunder:

Step 1: Budget Period

The first step in preparing a Cash Budget is ascertaining the period of Budget. The managers have to decide whether to prepare a short or long-term budget.

Step 2: Estimate Sources and Application of Cash

The next step is identifying and estimating the sources and applications of cash. For this purpose, the finance manager forecasts their requirements for the budget period.

Step 3: Method of Cash Budgeting

The third step is the selection of a suitable Budgeting Method. The selection of the methods depends upon the budgeting duration and objectives.

Step 4: Cash Position

After that, the managers estimate the cash balances at the beginning and end of the budget period. The closing cash position can be obtained from any of the abovementioned methods.

Step 5: Analysis of Cash Budget

The final step is the analysis of the cash budget. The study thoroughly compares the actual results with the budgeted results. And taking corrective measures in case of any deviations.

Preparation of cash budgets benefits the organizations in the following ways:

Some limitations of cash budgets are as follows:

To conclude, Cash Budget lays attention on the actual flow of cash within and outside the business. It provides an insight into the cash position and vital information for financial planning.

In practice, firms prepare these budgets to match the need for cash and capital budgeting.